With Starlink launches, SpaceX is poised to dominate satellite broadband and possibly bring billions of people online.

Elon Musk’s SpaceX has already captured the record for having the most operational satellites in space, with 180 Starlink satellites deployed.

On Monday, the United States-based SpaceX is scheduled to launch 60 more – its second Starlink launch this month. There’s also a third launch on tap for January, with 21 more sets bound for Low Earth Orbit (LEO).

And there might be even more satellites – thousands more – yet to come.

All those Starlink satellites circling high above the Earth are designed to be pieces of a greater whole – an LOE “mega-constellation”.

Unlike high-altitude, high-latency geostationary satellites used by television broadcasters among others, SpaceX’s LOE constellation aims to “deliver high speed broadband internet to locations where access has been unreliable, expensive, or completely unavailable”.

If Musk can build it out, he will be positioned to have the most satellite communications customers on Earth – and crucially – the greatest number of broadband customers too.

Fidelity Investments and Alphabet, Google’s parent company, have already bet a billion bucks on Musk’s SpaceX, having acquired a stake just shy of 10 percent of the company.

Advocates working to bring broadband to billions of unconnected people around the world see Musk’s effort as a way to close the connectivity divide between the global north and the planet’s least developed regions, where only 19 percent of people had internet access last year, according to the United Nations.

“I think exponential change is possible right now,” said David Hartshorn, CEO of Geeks Without Frontiers, a non-profit organisation that is neutral about which technology connects people to the internet, so long as it gets more of them online.

“Around about now you can get profitable business models … for connectivity for what is referred to as the bottom of the pyramid: those who are currently and stubbornly unconnected, because until recently they’ve been unreachable,” Hartshorn told Al Jazeera.

Constellation mega-disruption

Industry experts say Musk’s play may not just be about taking a sizable bite out of the terrestrial broadband market, but about Starlink becoming a dominant entrant into what Morgan Stanley predicts will be a $507bn satellite internet and broadband market by 2040.

Elon Musk’s company SpaceX already has the most operational satellites in Low Earth Orbit, but the colourful billionaire entrepreneur plans to launch tens of thousands more [File: Hannibal Hanschke/ Reuters]

That’s half of the predicted trillion-dollar 2040 global space industry.

Earlier this month, SpaceX’s Starlink team revealed that it intends to start offering affordable high-speed internet service to the northern US and Canada later this year, before expanding to near-global coverage.

Musk – also the CEO of automaker Tesla – has US Federal Communications Commission permission to operate 12,000 Starlink satellites, but is seeking a licence for a whopping 30,000 more.

“The amount of bandwidth offered by Starlink will be a game-changer for the fastest growing populations on our planet,” the Telecommunications Industry Association’s Vice President of Standards David Bain told Al Jazeera. “To answer the question, yes. Starlink and the other mega-constellations are potentially disruptive.”

Over the course of 2019, SpaceX and its nearest competitor, OneWeb, have both demonstrated that their LEO constellations are capable of delivering high-speed, low latency broadband on land and sea as well as in the air.

OneWeb has six broadband satellites in orbit and 34 scheduled to launch in early February. While it may not have the numbers of Starlink or an in-house launch system, it does have $3.4bn in funding and enviable partners that include multinational heavyweights such as Airbus, Bharti Enterprises and Coca-Cola.

Another notable contender is Amazon CEO Jeff Bezos’s self-funded Project Kuiper, which is in the earlier stages of development and will almost certainly make use of the maturing launch capabilities of Bezos’s private space company, Blue Origin.

All of these plays are targeting the same potential consumer pool.

Satellite broadband’s target consumer

Roughly half of the world’s stakeholders – some four billion people, mostly in Asia and Africa – are unconnected to the internet, and 1.7 billion are unbanked.

Connect those people to the internet and they can access life-changing financial services through mobile money platforms.

Earlier this month, World Bank Group Chief Economist Pinelopi Goldberg wrote, “Greater access to broadband services and modern data infrastructure is foundational for less developed countries – and their poorest citizens – both to create and make use of such data.”

The majority of the unconnected are living in low-income households, with an annual income of no more than $1,025 and therefore even less disposable cash, according to the World Bank.

And because these areas have been cash-strapped, there has been no profit incentive for investors to fund broadband infrastructure by land, mobile network or satellite.

“Every so often companies, geniuses, entrepreneurs say ‘Hey! You know, let’s connect the unconnected.’ And it’s a very noble thought,” said Julie Kunstler, the principal consultant for broadband access Ovum.

“But when it comes to connecting the currently unconnected, what one has to remember is how poor much of that population is, how little money they have to spend on being connected. That becomes the business model question. Will Starlink help them? Well, what’s the cost?” she said to Al Jazeera.

There’s a small but notable graveyard of companies that have tried but failed. In November, LeoSat – which had dreams of operating 108 LOE broadband satellites – suspended operations, reportedly because its investors decided not to sink more capital into the venture.

Even Bill Gates failed

“For those of us who have been in the satellite industry for decades, what we see happening right now tends in the direction of deja vu,” said Hartshorn.

During the 1990s, a collage of dreamers, proven innovators and investors with newly acquired fortunes corralled around the proposition of bringing broadband to the vast, untapped market of the unconnected populations via fleets of LEO satellites.

Along with Iridium, Globalstar, Astrolink and Ellipso, another firm chasing that dream was the now-defunct Teledesic.

Teledesic was midwifed in 1990 when Microsoft founder Bill Gates joined forces with Craig McCaw, who had sold McCaw Cellular Communications to AT&T for billions. The billionaire duo roped in another member of their crowd, Saudi Prince Alwaleed bin Talal – as well as corporate giants Boeing Co and Motorola – to sweat to launch 840 satellites by 2001.

After repeated delays, financial misadventures and no less than six CEOs, coupled with a customer base that found cellular technology a cheaper and more sustainable alternative, Teledesic turned off the lights in 2002. Not one satellite was launched.

“So in the 90s you had a number of companies, and it was investors rushing forward to launch … And all of them went bankrupt, repeat all of them went bankrupt,” Hartshorn said.

“A couple of them were purchased for pennies on the dollar by new ownership who then rewrote the business plans,” he added.

Those business plans bypassed the unconnected and went straight for a customer base with a proven ability to pay for services and a clearly definable problem that satellite connectivity could solve. To this day, they provide high-speed communications services to the commercial fishing, mining, and shipping industries – and to aid organisations, as well as governments, especially in the defence sector.

Can Starlink flip the script?

But as a new decade dawns, new players are poised to the flip the script back to the original.

“Starlink and the other mega-constellations are potentially disruptive, and a great part of that disruption will be in the Middle East and Africa regions,” Bain said.

But it’s not just about building the mega-constellation. LEO broadband service providers will need international permissions for using specific frequencies. They’ll also have to either develop or pay for a host of complementary technologies, such as satellite uplinks, downlinks, distribution channels, and possibly even handsets. Apple reportedly has one in development.

But all of that earthbound infrastructure may jack up the cost of providing LEO broadband – and possibly price out the poorest unconnected.

“The capital expense of getting thousands of satellites into orbit is very high. And they’re going to have to get a significant amount of revenue in to cost justify that expense,” said Hartshorn.

“Can they do that off the back of low-income communities in a way that is viable, enduring and sustainable? That is the multibillion-dollar question.”

SOURCE: AL JAZEERA NEWS

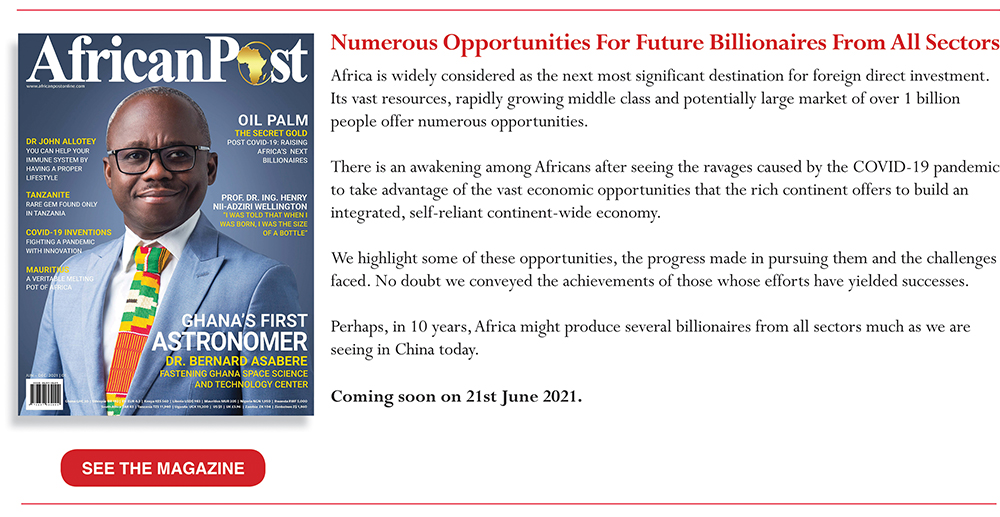

Putting a spotlight on business, inventions, leadership, influencers, women, technology, and lifestyle. We inspire, educate, celebrate success and reward resilience.