With the rate of streaming growth decreasing in the USA and the UK, music streaming services new and old have set their sights on tapping into new markets. Although entrance into new markets have been met with lawsuits and lower subscription prices the opportunity is way larger than it may appear, as the majority of the upside has yet to be captured.

While the reach of distribution continues to grow, the music industry has prioritized expanding the amount of total listeners without fully tapping into the fandom opportunities that exist in markets that traditionally have not been very accessible.

By exploring the opportunity in West Africa, specifically Ghana and Nigeria, I seek to explain why emerging markets all over the world present a unique opportunity for artists to benefit from increased fan engagement as these listeners typically have less opportunities to exercise their fandom.

Rise of Afrobeats

The democratization of music creation has contributed to the rapid ascent of Afrobeats. In 2019 we saw multiple Afrobeats artists on the Coachella stage, Universal’s signing of Tiwa Savage, and Davido selling out the O2. Not surprisingly, record labels have been the quickest to acknowledge this shift (i.e Sony opening an office in Nigeria in 2018) in an effort to stay competitive.

Major record labels are evolving to serve the needs of Afrobeats artists however, there has been little evolution from artists and their teams to meet the complex needs of West African fans, which can easily be hailed as one of the most influential fanbases in the world. A Quartz article highlighted the nuance and opportunity of the West African fanbase by stating:

“This built an audience not just at home but with a growing diaspora market of first- and second-generation young Africans in the suburbs of cities like London and Atlanta earlier this decade. Early on, it meant Nigerian and Ghanaian artists, with next to no promotion or marketing, could build international audiences made up of those suburban diaspora kids who watched their music videos endlessly on Vevo.”

Music tour stops in West Africa are few and far between

Thanks to the global-ness of the African diaspora, artists embraced by this fandom become international acts from day one thanks to a dense fanbase that resides all over the world.

Knowing this, why haven’t bigger artists (yes, I am looking at Beyonce and Jay-Z) capitalized on this by touring in West Africa?

J.Cole shut Lagos down when he performed in Nigeria (in videos of the performance the crowd starts chanting before he even appears on stage). While Cole puts on a great show the ultimate significance of his performance to his West African fans was simply his presence.

Everytime I see a major international music tour announced, West Africa seems to be conveniently left off the lineup. Infrastructure issues aside, music artists should look at performing in these markets as an investment that grows their defensibility and improves their chances at longevity. Since fans in Ghana and Nigeria have less of an ability to interact and express their fandom physically (i.e concerts, clubs, meet and greets) an artist needs to engage in a lot less physical fan touchpoints to benefit from increased fan loyalty and engagement compared to more established music markets like the USA and the UK.

It is imperative that artists entering these markets do their research and prepare for the nuances that each market presents. As tourism rises in Ghana and Nigeria there has never been a better time for international acts to hit the stage. As artists create a performance strategy, they should prioritize understanding tourism trends to provide their fans, local and visiting, with differentiated experiences that combine the uniqueness of the country that they are visiting and their brand identity.

Centering a tourism experience around a music artist

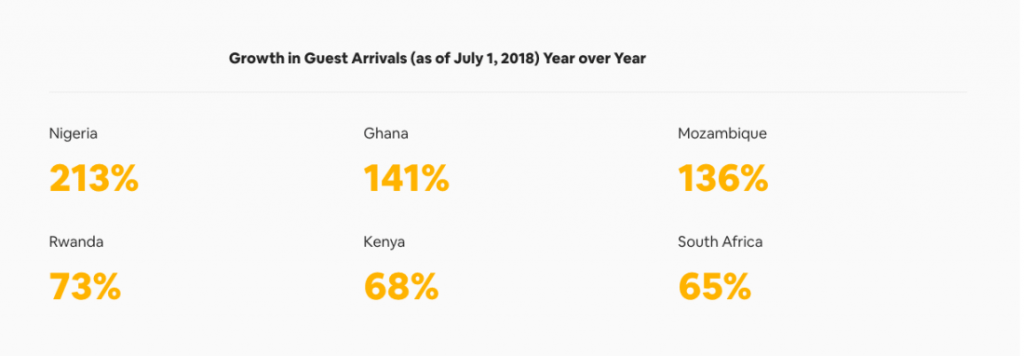

In September 2018 Airbnb published “The Fastest Growing African Countries for Airbnb Guests”. Unsurprisingly, Nigeria (213%) and Ghana (141%), were the top two fastest growing countries for guest arrivals on the platform. With both countries focused on increasing tourism in the next few years, these numbers will only continue to rise.

Ghana declared 2019 as the “Year of Return” a formal initiative encouraging people of the African diaspora to take a birthright trip to the country. The Year of Return is a catalyst for a longer tourism play as the country has revealed a 15 year tourism plan that seeks to increase the annual number of tourists to Ghana from 1 million to 8 million by 2027. As the most populous country in Africa, Nigeria has put less of a focus on increasing tourism, however has been dominating in the category (just look at the Airbnb numbers) nonetheless. According to Wesgro, “the majority of travelers to Nigeria are from nearby countries like Benin, Niger, Liberia, Cameroon, Chad and Sudan from where access to Nigeria is easy.”

It is easy to infer that an international artist choosing to perform in Ghana or Nigeria will not only encourage the people of that country to attend but people from neighboring countries as their access to their favorite artists is even more limited.

Festivals have become a commodity and as the lineups start to look more or less the same, the right location allows festival producers to differentiate themselves through something other than the artist lineup. Part of the reason Fyre Fest was able to sell so many tickets was the appeal of going to the Bahamas. While the festival was the arc of the trip, the experience of visiting the Bahamas became much bigger than the setlist. As a result, artists have a really unique opportunity to benefit by creating packages that not only include concert tickets, but additional experiences centered specifically around the country they are visiting.

By partnering with tourism boards they can promote their show while adding an additional stream of revenue through a direct deal with a tourism board or commission. This approach has worked for Canada with it being estimated that Drake is worth $440M or 5% of the cities tourism economy. As someone whose first visit to Toronto was to see a Drake concert I am actually shocked it is not larger.

The Ghanaian music festival Afrochella, has leveraged this dynamic brilliantly through their package offerings. While only in its third year, the festival is offering attendees two additional packages that include everything from additional events, a group chat community, and transportation to a multi-day experience complete with hotels, breakfast, and the ability to pick and choose amongst tourist attractions.

Opportunity for recording labels to differentiate themselves

When is the right time in a music artist’s career to begin pursuing such a time intensive strategy?

While every tourism board and country is different, I think that as long as an artist has the proper resources this strategy can work for artists small and big. As labels struggle to differentiate themselves creating deep partnerships with tourism boards so they can spin up these experiences quickly is a super compelling value-add for artists that have aspirations to be global. Artists have the ability to implement this approach on a small or large scale and can partner with local businesses instead of working with tourism boards as well.

By leveraging an international show to bring in multiple streams of revenue it allows artists to offer a lower price point (without sacrificing their bottom line) while connecting with their fans through a variety of avenues. As artists use their influence to encourage fans to visit new countries it is imperative that there is a nuanced enough understanding of the country to ensure that the experiences proposed will work for tourists and locals.

Besides artists, music streaming services have the largest short term upside if they double down in Ghana and Nigeria. As subscription growth continues to reach its peak in the Nordics, United States, and many parts of Europe the race to expand further has become even more competitive. Spotify was so desperate to launch in India, they decided it was worth the inevitable legal battle that immediately ensued with Warner. The streaming service has primarily focused the bulk of its African efforts on North Africa with a department titled “MENA” specifically focused on the Middle East and North Africa.

Apple Music on the other hand is available in Ghana and Nigeria at a time where Spotify, Tidal, and Amazon Music are not. With such low switching costs for streaming services these companies have a great opportunity to benefit from the lower customer acquisition cost and potentially even longer customer lifetime value as consumers in Ghana and Nigeria currently suffer from a limited range of options.

Why Telcos present a challenge for music streaming services

The challenge for music streaming services in Africa has largely been attributed to the large take rate telecommunications companies have traditionally commanded in response for allowing streaming services to transact on their platform.

With more than 95% of consumers in Africa accessing the Internet by mobile phone, their dominance presents a large factor in a music streaming companies ability to grow. This dynamic has led to emerging streaming services prioritizing having favorable deals with telcos as a core part of their go to market strategy.

Chinese backed streaming service, Boomplay, announced a $20M Series A earlier this year. The streaming service has reported previously that it has 36 million users and has grown to become the fastest growing streaming and music download app in Africa.

Further research into Boomplay reveals that the company was founded by Transsnet. Transsnet is a joint venture between Chinese phone maker Transsion and consumer apps conglomerate Netease. As more established streaming services enter the market they should consider acquiring an already established streaming service in the area to gain a large amount of market share quickly or brokering a deal that includes the telco’s from day one.

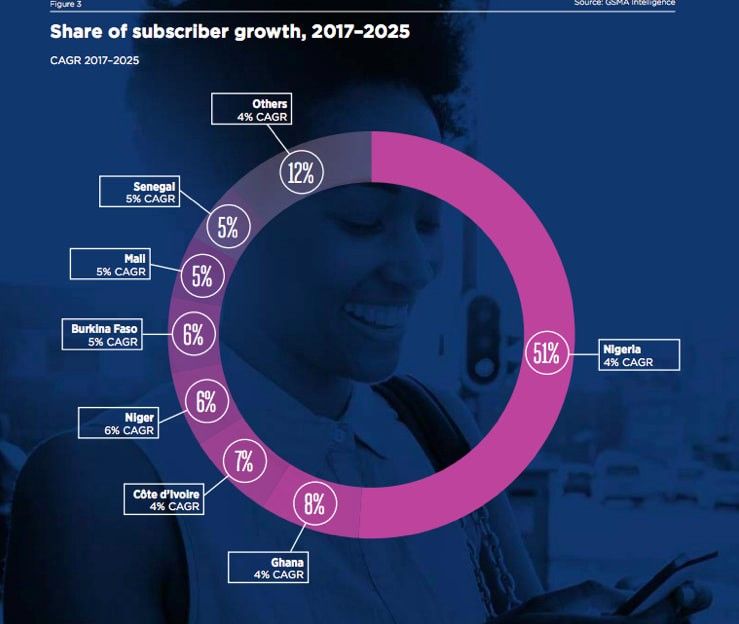

Mobile phone adoption is still far from hitting his peak in West Africa and will grow exponentially in the next ten years. By 2025 around 72 million new mobile subscribers will be added in West Africa, taking subscriber penetration to 54% (GSM Association, The Mobile Economy of West Africa). This presents a significant opportunity for more established streaming services as they seek to grow subscribers past markets that have begun to taper off.

How Ghana and Nigeria could be Tidal’s secret weapon

Tidal can easily navigate the challenges that any music streaming service would encounter when entering Ghana and Nigeria because of the companies owners. Combining the Tidal brand (which in a lot of ways is Jay Z’s brand) with Sprint’s (they bought 1/3 of Tidal in 2017) negotiating power against telcos, it gives them a strong advantage to try and penetrate the market.

Tidal’s differentiation strategy has largely been around exclusive content and early access to concerts and festivals which can be mediocre at best when trying to convince consumers to switch over. However, through a series of strategic acquisitions Tidal can easily build up the brand and content infrastructure it needs to thrive in Ghana and Nigeria.

Additionally, by leveraging its influence it can play an integral role in helping music artists deepen fan engagement by helping them facilitate their own concerts and experiences in these countries, or through a festival bringing them there for the first time. While only in in its third year the purchase of a prominent festival such as Afrochella can help take the festival to a new level, increase Tidal’s brand (and inevitably subscribers) among West Africa, and positions Tidal as the leader in helping bring American artists to the continent without them or their teams having to handle the upfront costs of an inaugural performance.

It also allows Tidal to continue to reposition itself to consumers especially after dealing with negative public sentiment due to their grandiose launch.

Earlier in 2019, YouTube announced an initiative at the Google for Nigeria conference with Nigerian music artist, Mr. Eazi. The initiative will provide direct support for 10 emerging artists from Nigeria with Lyor Cohen stating:

“There is so much talent exploding out of Nigeria and the African continent right now. Africa is setting the tempo all around the globe.”

We shall see

There is a plethora of opportunities in Ghana and Nigeria.

As both countries continue to see an increase in tourism, smartphone penetration, and cultural influence, it is imperative that different stakeholders in the music industry define and prioritize a strategy to tackle West Africa and ultimately the rest of the continent moving forward.

iafrikan.com

Putting a spotlight on business, inventions, leadership, influencers, women, technology, and lifestyle. We inspire, educate, celebrate success and reward resilience.