Ghana- Golden Star Resources Ltd has recently announced that it has entered into a binding agreement for the sale of its 90% interest in the Bogoso-Prestea Gold Mine in Ghana to Future Global Resources Ltd (FGR) for a purchase price of up to US$95 million (the transaction).

Highlights

- Golden Star has signed a binding agreement for the sale of Bogoso-Prestea to FGR.

- Purchase price of US$55 million with a further contingent component of up to US$40 million.

- Staged payments to ensure FGR focuses investment capacity on the asset itself while providing Golden Star with exposure to its long-term growth potential.

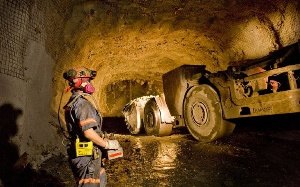

- Operations are planned to continue at the Prestea underground operation, which includes the use of alimak mining on 24 Level and long hole open stoping mining activities on the newly developed 17 Level.

- Following the acquisition, FGR intends to review the entire Bogoso-Prestea project portfolio, which includes the significant refractory sulfide resource, and an extensive tenement package with exploration potential.

- The sale strengthens Golden Star’s balance sheet and allows the company to accelerate the growth and development of the large resource base at the Wassa mine and increase exploration activities in the wider Wassa-HBB project area.

- Following the satisfaction of the closing conditions in the agreement, including obtaining the required government approvals, the transaction is expected to complete by no later than 30 September 2020 (closing).

Financial terms

FGR will acquire Bogoso-Prestea for US$55 million on a cash free, debt free and working capital free basis, which will be paid as follows:

- Consideration of US$30 million comprising of US$5 million of cash and the assumption by FGR of approximately US$25 million of negative working capital is payable at closing.

- US$10m of cash is payable on 31 July 2021.

- US$15m of cash is payable on 31 July 2023.

FGR will assume Bogoso-Prestea’s assets and liabilities. Blue International Holdings Ltd (the major shareholder of FGR) will act as guarantor for the above payments.

In addition to the consideration payable at closing and the deferred payments, a contingent payment of up to US$40 million conditional upon the occurrence of the milestones described hereinafter in respect of the development of the Bogoso Sulfide Project (the contingent payment) may become payable by FGR to Golden Star. The trigger point for the contingent payment is either (i) FGR’s formal decision to proceed with the Bogoso Sulfide Project, or (ii) the extraction of an aggregate of 5% of the sulfide resources as stated at the end of 2019, being 1.76 million oz of measured and indicated resources and 0.07 million oz of inferred resource. The quantum of the contingent payment is determined by reference to the average spot gold price for the 90 day period preceding the date of the decision to proceed:

- US$20 million, if the average spot gold price is less than or equal to US$1400/oz.

- US$30 million, if the average spot gold price is greater than US$1400/oz but less than or equal to US$1700/oz.

- US$40 million, if the average spot gold price is greater than US$1700/oz.

The contingent payment is payable in two tranches:

- 50% at the time of (i) the decision to proceed, or (ii) declaration that 5% of the sulfide mineral resources have been extracted.

- 50% at the time of the first anniversary of (i) achieving commercial production following the decision to proceed, or (ii) the first anniversary of the declaration that 5% of the sulfide mineral resources have been extracted.

Transaction schedule

The transaction is anticipated to close by no later than 30 September 2020 upon satisfaction of the conditions precedent set forth in the agreement. These include approval of the relevant Minister in Ghana and the restructuring of the Royal Gold Streaming Agreement and Macquarie loan facility.

Restructuring of RGLD Gold AG streaming agreement

Caystar Finance Co. (a wholly-owned subsidiary of Golden Star) and RGLD Gold AG (an affiliate of Royal Gold Inc.) are parties to a streaming agreement covering the Wassa and Bogoso-Prestea mines. Golden Star, FGR and RGLD Gold AG are in advanced discussions to amend the stream agreement that would see, subject to the completion of terms, negotiation of definitive agreements and receipt of board of directors’ approvals, a separation of the obligations under the agreement as between the Wassa and Bogoso-Prestea mines.

Andrew Wray, President and CEO of Golden Star, commented: “We are pleased to announce the sale agreement for Bogoso-Prestea as this brings fresh focus and investment capacity to the asset, while enabling us to concentrate our financial and technical resources on accelerating the delivery of value from Wassa as it continues to develop into a large-scale, long-life and cash generative underground mine.

“The sale strengthens our balance sheet by providing a cash inflow of US$30m by 2023 and Golden Star will be able to participate in the upside offered by the Bogoso Sulfide Project through the Contingent Payment mechanism which could deliver up to a further US$40 million to the business. Given the resulting improvement in the financial position of the company we expect to now be able to accelerate our investment at Wassa and within our existing exploration pipeline and look for other opportunities to further expand our business.

“Bogoso-Prestea will also benefit from having an owner solely focused on delivering the turnaround of the underground operation and assessing the significant potential of the sulfide resources. As a result, we see this transaction as positive for both FGR and Golden Star, our employees, Ghana, the host communities and all of our other stakeholders.”

Glenn Baldwin, CEO of Future Global Resources, added: “FGR is delighted to acquire 90% of the Bogoso-Prestea Gold Mine as our first production asset. FGR is looking forward to engaging with the workforce, communities and government of Ghana, developing constructive and sustainable partnerships. We have confidence in the potential for additional discoveries and extensions to the underground mineral resources, through which we hope to generate real value by investing in the workforce and our relationships with local stakeholders.”

globalminingreview.com

Putting a spotlight on business, inventions, leadership, influencers, women, technology, and lifestyle. We inspire, educate, celebrate success and reward resilience.