GHANA- (“Asante” or the “Company”) is pleased to report that it

has received notice from the Minerals Commission of Ghana that eight highly prospective concessions covering approximately 314 sq. km have been recommended for transfer to Asante.

These licenses are comprised of the Diaso (104.1sq. km), Juabo (59.2 sq. km), Manhia (18.69 sq. km), Dunkwa Gyimigya (32.72 sq. km), Gyimigya (5.52 sq. km), Agyaka Manso (40.0 sq. km), Amuabaka (28.86 sq. km) and Nkronua-Atifi (24.97 sq. km) prospecting licenses (PL’s). All licenses are being acquired, on an as issued by the Minerals Commission basis, from Goknet Mining Company Limited (the “Vendor”) pursuant to the terms of agreement with Goknet dated December 28, 2016. The concessions were variously explored by Canadian exploration juniors Nevsun Resources, Tri-Star Gold and Golden Rule Resources in the late 1990’s, and most recently by PMI Gold Corporation (now Galiano Gold) from 2002 thru August 2014 when rights to the land was acquired by Goknet.

Extensive work programs consisting of airborne magnetic, electromagnetic and radiometric surveys, ground geophysics, regional silt and detail soil sampling, auger, aircore, reverse circulation and diamond drilling and advanced exploration/structural interpretations have been completed. Multiple areas with initial discovery drill holes have been outlined for further follow up by Asante.

The Juabo, Diaso and Manhia concessions are contiguous/on strike with our Keyhole Gold project, an area, which has been the subject of extensive alluvial mining over a 7km length over the past 40 years. Their acquisition will finally allow the company to commence an aggressive exploration program to locate the bedrock source of the gold mineralization under the Ankobra River, a strong northerly trending structure which stretches 200km from the goldfields at Tarkwa/Prestea to Newmont’s Ahafo gold mine.

The Company will issue 375,000 fully paid common shares of the Company for each of the PL’s so transferred, to a maximum of 3,000,000 shares, and reserve for the vendor a royalty equal to 2.0% of the Net Smelter Returns on each of the concessions transferred. Shares issued will be subject to a hold period expiring four months and one day from the date of issuance.

In addition, 80% of the shares issued will be held in escrow and released as to 10% every 3 calendar months after the date which is four months and one day after the date of their issue.

Goknet and the Company are related by one common director. The acquisition was negotiated and approved by a Special Committee of the Directors of Asante and disinterested shareholder approval for the transaction was obtained at the Annual General Meeting of Shareholders held on December 28, 2016.

Douglas R. MacQuarrie”

President & CEO

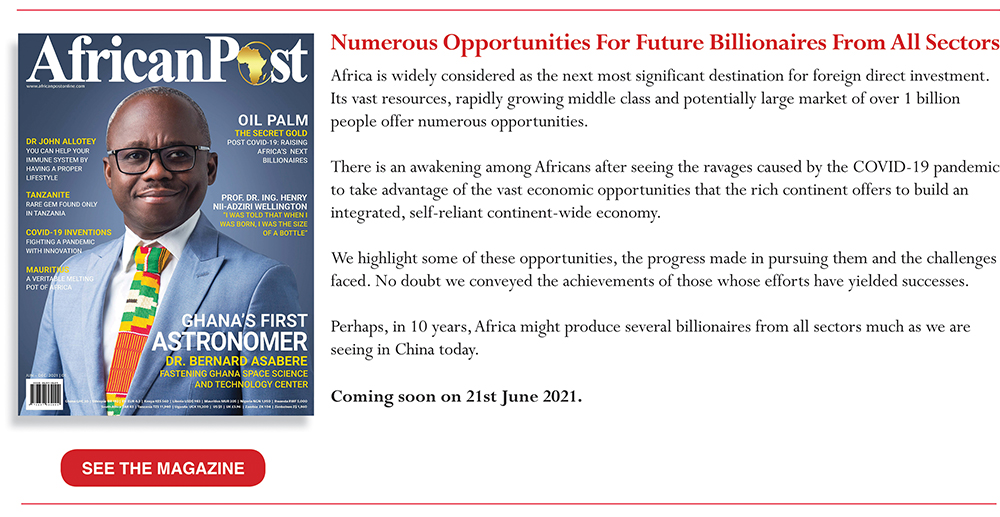

Putting a spotlight on business, inventions, leadership, influencers, women, technology, and lifestyle. We inspire, educate, celebrate success and reward resilience.